News & Releasess

Autohellas: Group Results for the 4th Quarter & Year 2021

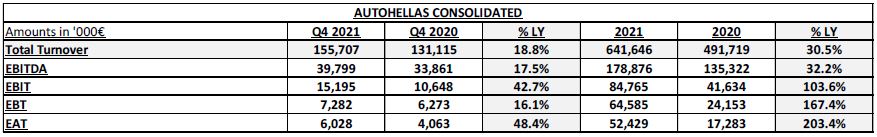

Strong Momentum with Turnover increase 30% at €641.6m.

Increase in Profitability 200% with Profit after Taxes at €52.4m.

Doubling of the proposed Dividend at 0.46 euro /share

Autohellas Group announces the fourth quarter and full year financial results for 2021, showing strong momentum both at the levels of Group Consolidated Turnover and at profitability levels. More specifically, in 2021, Turnover increased by 30.5%, reaching €641.6m. compared to €491.7m. in 2020. Operating Profit (EBIT) amounted to €84.8m. compared to €41.6m. in 2020 recording an increase of 103.6% and Earnings after Taxes (EAT) for the Group for the year 2021 amounted to €52.4m. compared to €17.3m., an amount triple to that of 2020.

The figures for 2021, despite the prolonged lockdown of the first four months of the year and the delayed resumption of tourism activity from June, are significantly higher than those of 2019, before the impact of the pandemic, and constitute a new record high for the Group.

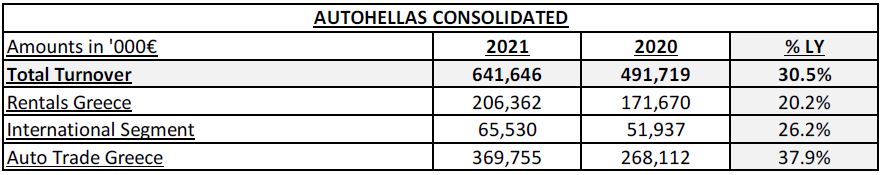

More specifically, Group’s Turnover from car rental in Greece increased by 20.2% in 2021 and reached €206.4m. Long-Term Rental, with a strong increase in demand, supported the Company during the weak, also due to the lockdown, 1st semester of 2021. However, during the 2nd semester, the production issues that car manufacturers faced (components’ shortage) kept the number of deliveries to clients with new contracts low, creating though a very large “portfolio” of pending deliveries for 2022.

At the same time, with tourism recovering, short-term rental activity during the 2nd semester of the year was almost double in turnover compared to 2020, and larger than 2019, which was a record year for tourism. The company invested, in time, in almost 4,000 new cars to strengthen the fleet of short-term rentals and possessed, by far, the largest, of the highest quality and the most enriched with electric vehicles fleet. This investment, with the simultaneous constant upgrade of the organization and the infrastructure of the company, resulted in higher market shares in all of the country’s main touristic regions.

The Group recorded growth also in the activity that relates with car-rentals in the 7 countries that it operates in abroad, with turnover reaching €65.5m., recording an increase of 26.2% compared to 2020. However, the international segment did not record growth in comparison against 2019 levels, since the recovery in tourism in those countries remained in lower levels than that of Greece.

On aggregate, fleet for short-term and long-term rentals reached 46,500 cars, with 11,050 total purchases and a net investment (purchases of new cars minus used car sales) of €131m.

Auto Trade operations also recorded significant growth, despite the components’ shortage that created significant delays and restrictions in production. The 3 wholesale companies of the Group (Hyundai, Kia, Seat importers) further enlarged their aggregate market share, reaching 15%, with an even higher share in “Retail” market (excluding “fleet” sales). Autotechnica/Velmar’s activity was also satisfactory in retail and after sales market. It is worth mentioning that all 4 Auto Trade companies of the Group operate with no borrowing as at 31.12.2021. Auto Trade’s Turnover amounted to €369.8m. recording an increase of 37.9% compared to 2020, whilst pending deliveries (outside the Group) surpassed 8,000 cars.

Strong profitability and cash flows (EBITDA 2021: €178,9m.), allowed for a small decrease in net debt (borrowings minus cash) to €330,8m., despite the strong investment, whilst the Group’s equity increased, reaching €321,3m. Autohellas’ Debt/Equity ratio is the strongest among the listed companies operating in the sector in Europe. The Board of Directors will propose to the General Meeting the doubling of the proposed dividend to 0.46 euros per share compared to 0.23 euros per share last year.