News & Releasess

Interim Financial Highlights for nine-month period 2019

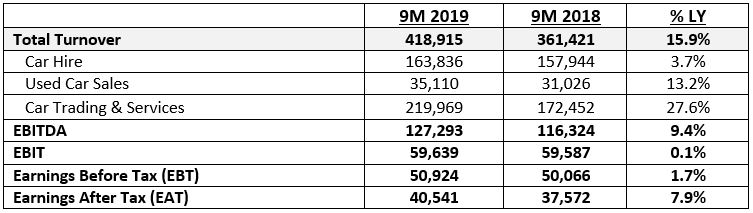

15.9% Turnover Increase up to 419mil.

Earnings After Tax 40.5 mil.

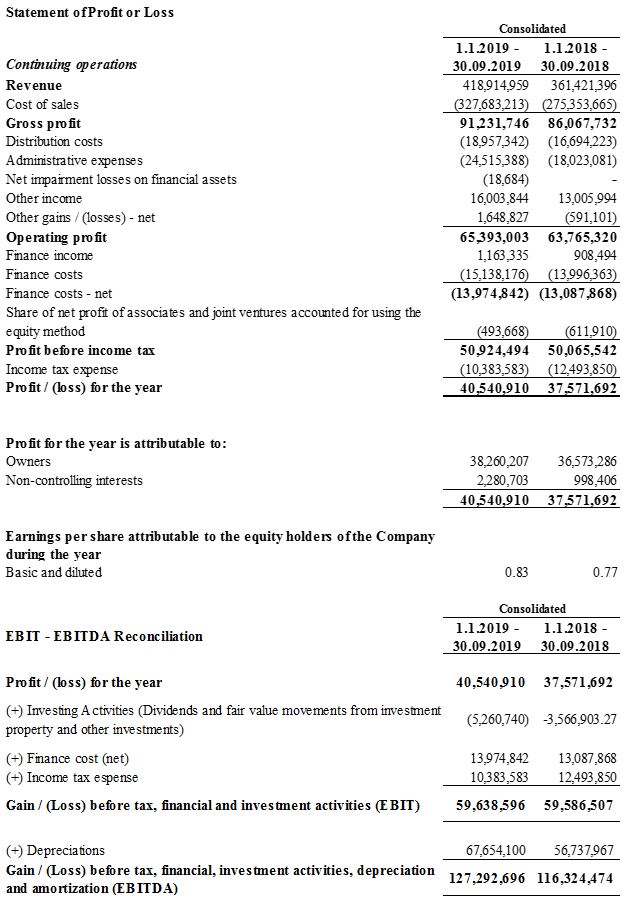

In the first nine months of 2019, AUTOHELLAS Group continued its growth path of financial figures, with the Group’s turnover reaching € 418.9m, compared to € 361.4m. in the respective period of 2018, recording a 15.9%. In same period earnings before interest, tax and depreciation (EBITDA) reached €127.3m. an increase of 9.4%.

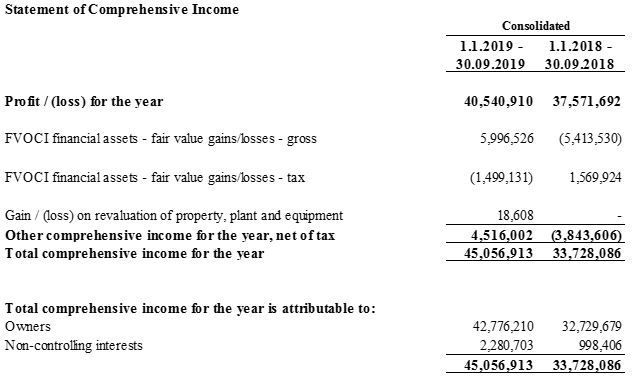

Earnings After Tax (EAT) reached € 40.5m, from € 37.6m in the nine-month period of 2018, up 7.9%.

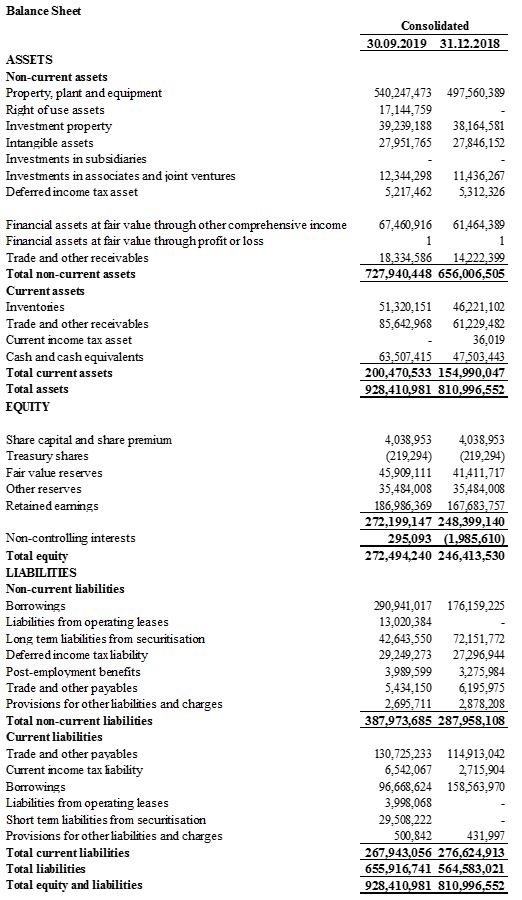

Group Equity reached € 272.5m. as at 30/09/2019, against € 245.9m the respective period last year.

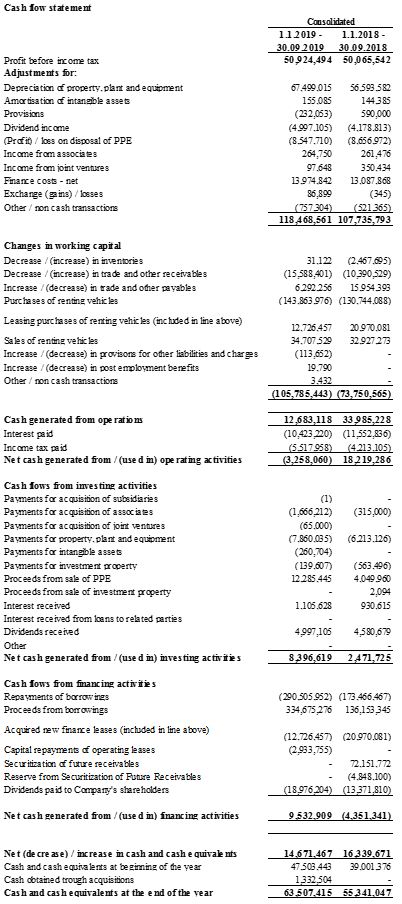

It is worth noting that in the first nine months of 2019 there was an investment of € 143.9m in new vehicle purchases, with the Group’s total fleet having increased by 2,900 cars as of 30/9/2018, reaching 47,600 cars, of which 35,100 in Greece and the remaining 12,500 in the 7 countries where the Group operates.

Rental activity in Greece and its International Subsidiaries increased by 3.7%. Long-term leases continued to grow both in Greece and Internationally, while short-term leases slowed down, affected by the marginally positive arrivals in Greece and overseas markets. Used fleet sales activity, being a complimentary to the rental activity, increased by 13.2% compared to the same period last year.

At the same time, the trade activity of new cars, spare parts and services contributed a total of € 219.9m. to the Group’s turnover compared to € 172.5m. in the respective period last year, showing an increase of 27.6% contributing 53% of the Group’s Turnover. The growth rate of the Auto Trade segment significantly exceeded the market growth rate of 10%, broadening its market share in the Greek market in both wholesale and retail level.

Note that the acquisition of ELTREKKA SA by the Group, impacted its turnover by only € 8m. during the nine-month period, since the transaction completed on 31 May 2019.

CONSOLIDATED RESULT:

Autohellas CEO, Mr. Eftichios Vassilakis stated: “The synergies between the Group’s activities are maturing. Despite the slowdown in arrivals and the intensification of competition, the track record is still positive. Expectations for further recovery in the car market as well as the progressive scaling-down of interest rate creates prospects for further growth. Of course, the environment remains competitive and The Group’s prospects are crucial for maintaining or expanding the market shares we have acquired.”

Lastly, the application of the new IFRS 16 accounting standard affected by € 17m. the consolidated Fixed Assets and Liabilities respectively and by € 300k. the consolidated result.