News & Releasess

1st Quarter 2025 Financial Results

Positive momentum in Rentals in Greece in the seasonally weak first quarter

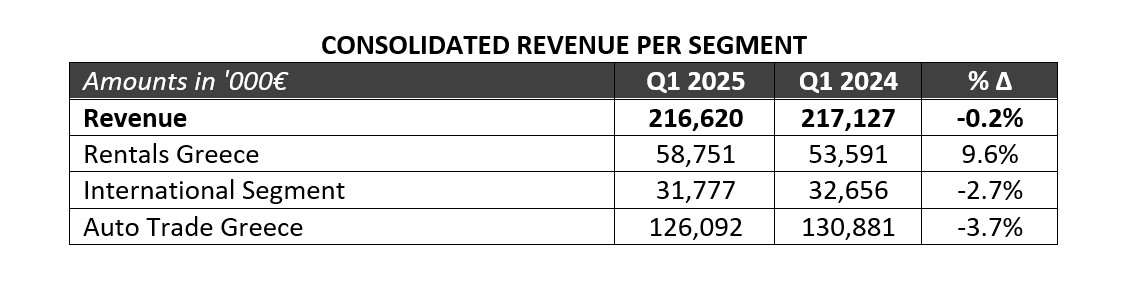

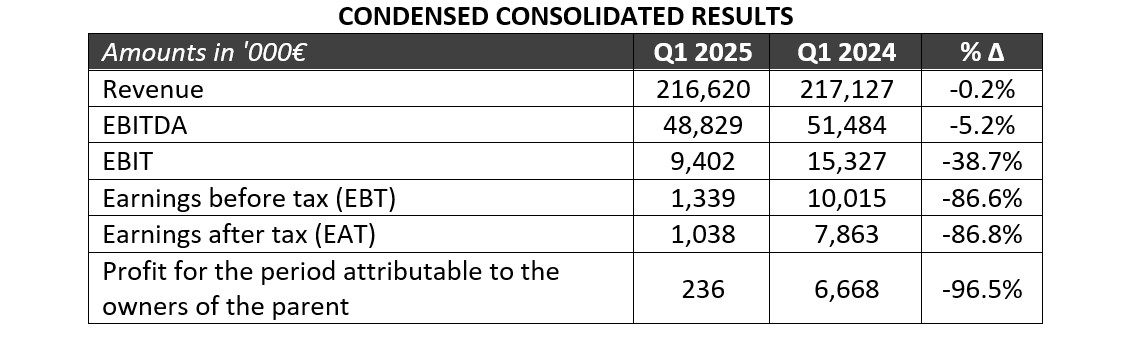

Consolidated Revenue at €216 million, with EBITDA at €48.8 million

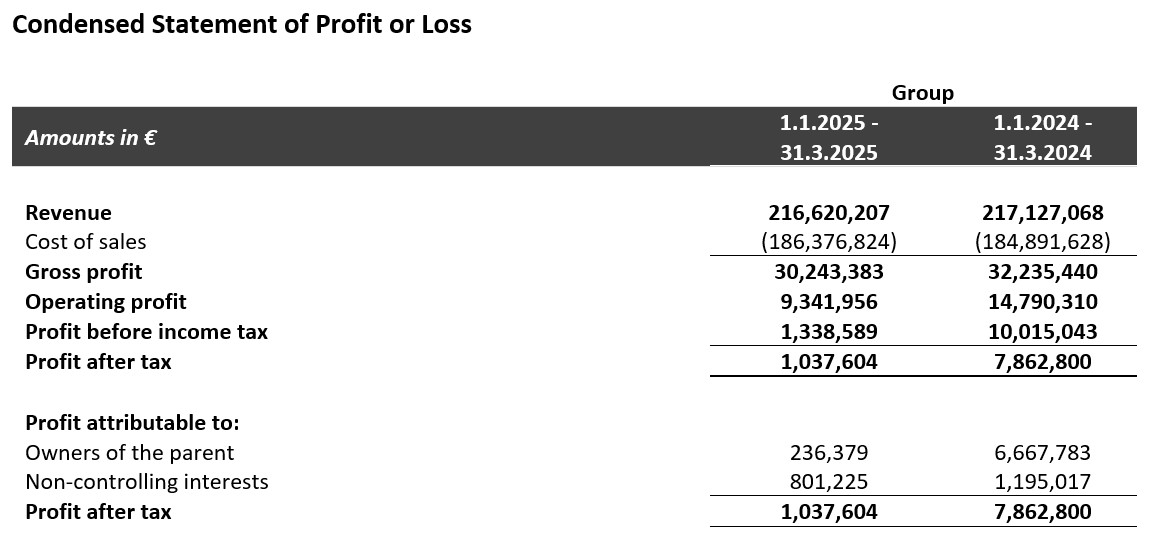

Autohellas announces its financial results for the first quarter of 2025, with consolidated Revenue amounting to €216.6 million and EBITDA reaching €48.8 million, compared to €51.5 million in the corresponding quarter of 2024.

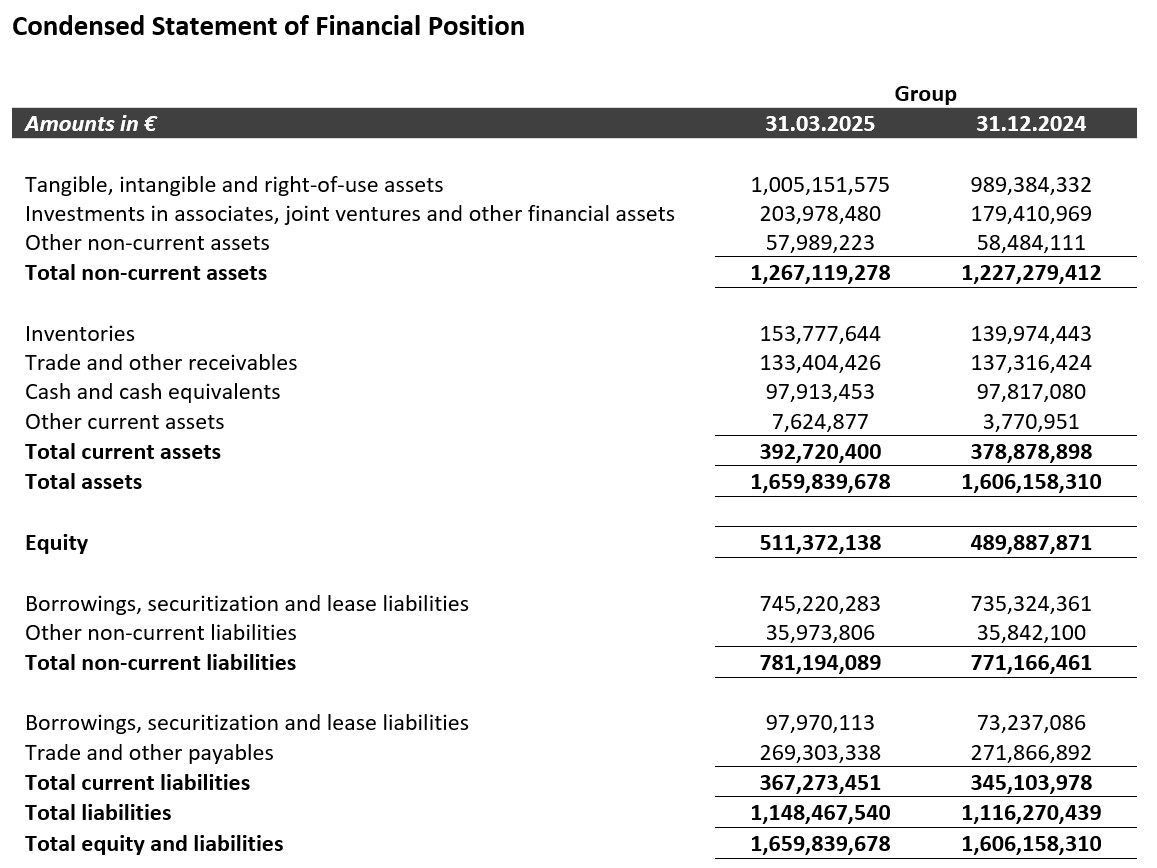

Earnings after Tax amounted to €1 million, with the decline in profitability, during the seasonally weakest quarter, primarily attributed to the absence of extraordinary gains recorded in the same period of 2024, which had resulted from gains from the termination of interest rate swap contracts. The Group’s Equity as at 31.03.2025 amounted to €511.4 million.

Analysis by Sector:

Greece Rentals

Revenue from the Car Rental activity in Greece increased by 9.6% in the first quarter of 2025 compared to the same period in 2024, reaching €58.7 million. This growth was driven by both short-term and long-term rentals. In particular, short-term rentals benefited from increased domestic demand and higher tourist arrivals — despite the fact that this is traditionally the weakest quarter of the year — within a context of restrained rental pricing. In long-term rentals, there was a significant increase in new vehicle deliveries, reflecting heightened demand and the signing of new contracts, which contributed substantially to the further expansion of the fleet.

International Activity

Revenue from the International Car Rental Activity amounted to €31.7 million, compared to €32.6 million in the first quarter of 2024. The increased availability of vehicle fleets continued to exert downward pressure on rental prices, leading to a moderate decline in rates compared to the same period last year. This development impacted operating profitability, particularly in the Portuguese market, which remains the only country within the Group where long-term operating leasing services are not offered.

Car Trade and Services

During the first quarter of 2025, the Car Trading activity in Greece recorded a slight decrease in revenue by 3.7%, contributing a total of €126.1 million to the Group’s consolidated revenue. This decline is mainly attributed to the overall market contraction during the quarter, as well as intensified competition due to the entry of new manufacturers and brands into the Greek market.

It is noted that the activity of Italian Motion (FIAT/JEEP/ALFA Romeo), which is not included in the Consolidated Revenue (accounted for using the equity method), recorded sales of €34.6 million in the first quarter of 2024, further enhancing the overall scale and momentum of the Group’s operations.

The strong momentum in tourist arrivals observed during the first quarter is expected to continue in the coming period, positively impacting demand for short-term rentals. The Company has invested in the acquisition of a significant number of vehicles during the current year, aiming to enrich and upgrade its fleet with higher-category vehicles. At the same time, long-term rentals continue to show an upward trend this year as well, both in conventional and hybrid/electric vehicles.